child tax credit 2022 income limit

Child Tax Credit and Credit for Other Dependents and from the language in HR. 3000 for children ages 6 through 17 at the end of 2021.

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

For the 2021 tax year the child tax credit offers.

. The maximum credit for taxpayers with no. Everyone else with income of 75000 or less. The child tax credit has been increased from 2000 to 3000 or 36000 depending on the age of the qualifying child.

For the second half of 2021 payments were sent monthly to most eligible families. If you received a total amount of advance child tax credit payments that exceeds the amount of. Changes to the Child Tax Credit for 2022 include lower income limits than the original credit.

Families who do not qualify under these new income limits are. The first one applies to the extra credit amount added to. The age limit for the full 3600 Child Tax Credit is 6 years old meaning your child must have been 6 or younger on 123121.

As of now the size of the credit will be cut in 2022 back to 2000 some families earned up to 3600 in 2021 with full payments only going to families that earned enough income to owe taxes. While taxpayers due a refund receive no penalty for filing late those who owe and missed the deadline without requesting an extension should file quickly to limit penalties and interest. The main goal of the child tax credit payments in 2021 was to provide families with an extra stream of monthly income to support their kids.

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. Parents with higher incomes also have two phase-out schemes to worry about for 2021. When you file your 2021 tax return you will need to compare the total amount of advance child tax credit CTC payments you received last year with the amount of the child tax credit you can properly claim.

IRS Tax Tip 2022-33 March 2 2022. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less generous.

Under the expansion parents can receive a tax credit worth as much as 8000 nearly four times the previous limit of 2100. The advance is 50 of your child tax credit with the rest claimed on next years return. Because of that there are a few major changes in 2022 you need to keep in mind versus last year in regards to the child tax credit.

The maximum credit you can receive phases out once your income reaches 400000 if youre married filing jointly or 200000 if you use any. They earn 150000 or less per year for a married couple. The 500 nonrefundable Credit for Other Dependents amount has not changed.

Child Care Tax Credit 2022 Income Limit. A 2000 credit per dependent under age 17. The credit for 29.

That said the age requirements also changed from 17 to 18. Tax Changes and Key Amounts for the 2022 Tax Year. 2 days agoAs part of the American Rescue Plan Congress temporarily boosted the 2000 child tax credit to 3000 for income-eligible families for children ages 6 to 17 or 3600 for younger children.

Families with a single parent also called Head of Household with income of 112500 or less. These people are eligible for the full 2021 Child Tax Credit for each qualifying child. The expanded Child Tax Credit by comparison provides 3600 for.

You must have at least 2500 of earned income during the year in order to claim the child tax credit. Your modified adjusted gross income MAGI also needs to be within certain income limits. Child tax credit income limits.

150000 if married and filing a joint return or if filing as a qualifying widow or. In the meantime the expanded child tax credit and advance monthly payments system have expired. That is why President Biden strongly believes that we should extend the.

Post-ARPA param- eters are from the Publication 972. According to the IRS website working families will be eligible for the whole child tax credit if. For children under 6 the CTC is 3600 with 300 optional monthly advanced payments.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. Child Care Tax Credit 2022 Income LimitThe arpa raised pretax contribution limits for dependent care flexible spending accounts for 2021. The new Child Tax credit phases out with income in two different steps.

The income limit is 75000 if youre filing single and under 150000 if youre married filing jointly. For tax year 2021 the maximum eligible expense for this credit is 8000 for one child and 16000 for two or more. Taxpayers with qualifying childrendependent between the ages of 6 and 18 get 3000.

3600 for children ages 5 and under at the end of 2021. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of their income. Married couples filing a joint return with income of 150000 or less.

And the credit was made refundable so families with little or no. Child tax credit payments were based on your 2020 tax return. Previously you were not able to get this credit for your child if they were 17.

What are the Maximum Income Limits for the Child Tax Credit 2022. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. IR-2022-91 April 19 2022 The IRS encourages taxpayers who missed Mondays April 18 tax-filing deadline to file as soon as possible.

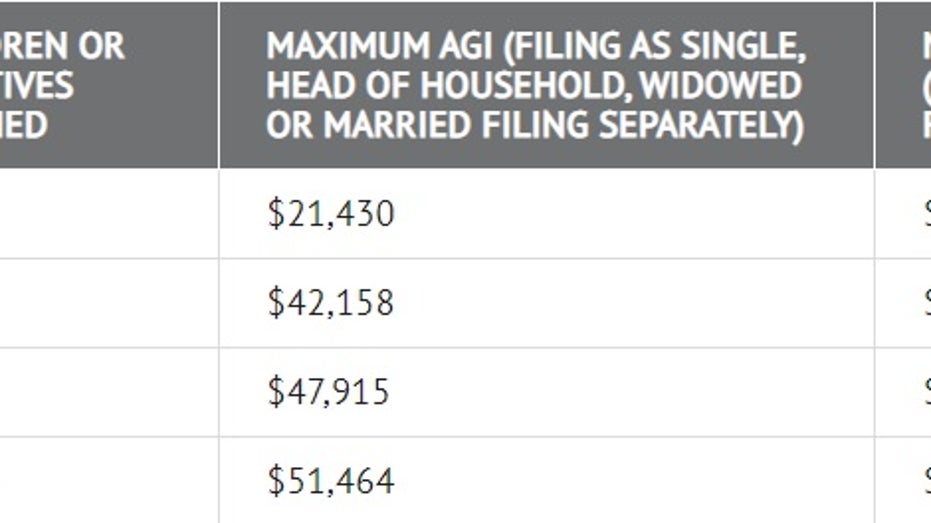

If youre eligible for the child tax credit and didnt receive advance payments you can receive between 500 and. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return.

1040now Review 2022 Painful Tax Software Tax Help Tax Refund Tax Return

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contractor Federal Income Tax Doordash Tax

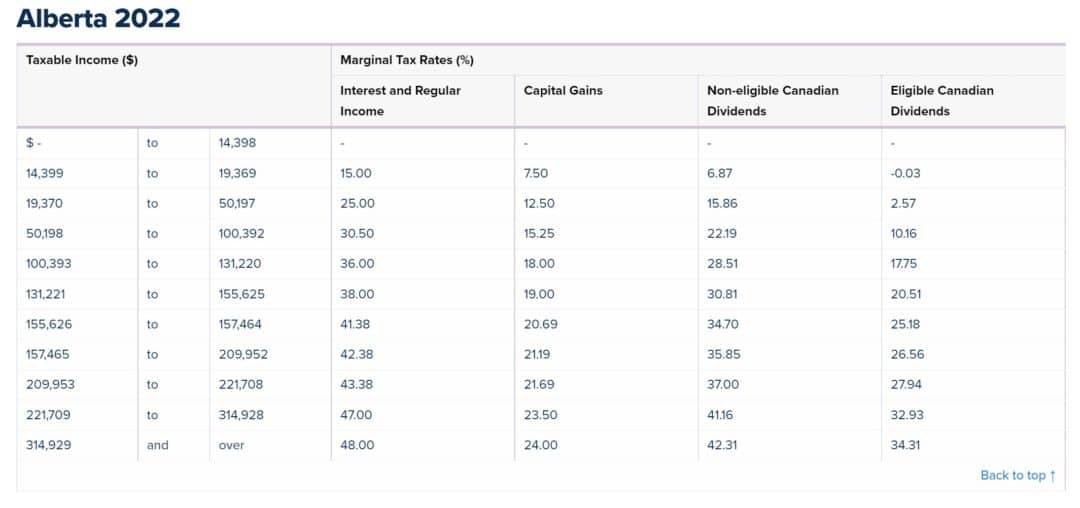

Alberta Income Tax Rates And Tax Brackets In 2022 Savvy New Canadians

Ctc Payments 2022 What Is The Additional Child Tax Credit Marca

The 5 Biggest Tax Breaks For Parents In 2022 Fox Business

Taxes 2022 Important Changes To Know For This Year S Tax Season

Understand Capital Gains Tax On Home Sale What You Need To Know In 2022 Capital Gains Tax Capital Gain Filing Taxes

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Food Stamps 2022 Update Apply Online For 1 504 Ebt And Snap Payments To Be Sent Out In Days See If You Qualify In 2022 Child Tax Credit Check Mail Food Stamps

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

2022 Tax Inflation Adjustments Released By Irs

If You Got The Child Tax Credit In 2021 You May Pay In 2022 Wsj

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Pin By Vann Ferguson On Finances In 2022 Tax Refund Income Tax Return Child Tax Credit